XRP Price Prediction 2025-2040: Comprehensive Forecast Analysis

#XRP

- Technical Momentum: Positive MACD and Bollinger Band positioning suggest near-term upward potential with key resistance at $3.40-$3.48

- Regulatory Clarity: Resolution of SEC lawsuit and warming U.S. policy create favorable regulatory environment for growth

- Institutional Adoption: ETF filings and increased whale activity indicate growing institutional confidence and capital inflow

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Despite Minor Pullback

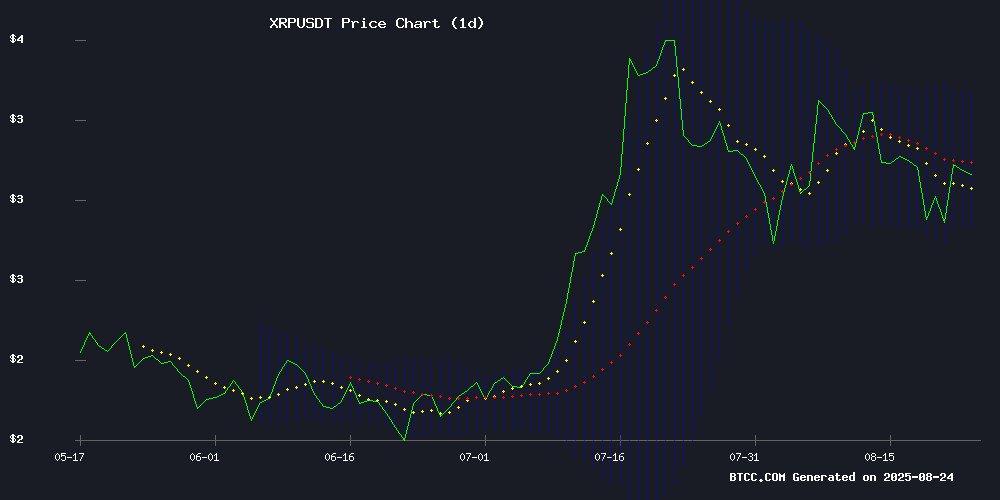

XRP is currently trading at $3.0319, slightly below its 20-day moving average of $3.0937, indicating a temporary consolidation phase. The MACD reading of 0.0869 above the signal line at 0.0387 suggests ongoing bullish momentum, with a positive histogram of 0.0482 reinforcing this trend. Bollinger Bands show price action between the upper band at $3.3572 and lower band at $2.8302, with the middle band at $3.0937 providing dynamic support.

According to BTCC financial analyst Ava, 'The technical setup suggests XRP is building energy for its next major move. The MACD remains positive and trading within the Bollinger Bands indicates healthy price discovery. A break above the 20-day MA could trigger momentum toward the upper resistance levels.'

Market Sentiment: Strong Fundamentals Support XRP's Long-Term Growth Trajectory

Recent developments have created a fundamentally strong environment for XRP. The resolution of Ripple's five-year SEC lawsuit has removed significant regulatory uncertainty, while CEO Brad Garlinghouse's declaration of a 'new dawn' reflects growing institutional confidence. Major players filing for XRP spot ETF products indicate increasing mainstream adoption, and surging whale activity suggests smart money is positioning for future gains.

BTCC financial analyst Ava notes, 'The combination of regulatory clarity, institutional interest through ETF filings, and positive technical indicators creates a compelling case for XRP. The $3.40-$3.48 analyst target range appears achievable given current momentum and fundamental catalysts.'

Factors Influencing XRP's Price

XRP Outlook 2025: Ripple's Resilience Tested by Rising Competitor Remittix

XRP's price trajectory remains a focal point for crypto analysts in 2025, with projections ranging from cautious optimism to bullish rebounds. Technical indicators suggest a potential rally, with the TD Sequential signaling a buy on hourly charts. Price targets hover between $3.06 and $3.41, averaging $3.23 in September and peaking near $3.30 in October.

Ripple's established infrastructure and regulatory clarity continue to provide competitive advantages in cross-border payments. Yet the emergence of utility-focused tokens like Remittix—with its real-world financial applications—poses fresh challenges. Market patterns reminiscent of 2017-2021 cycles are prompting some analysts to advise tempered expectations amid volatility signals.

The crypto sector's pivot toward practical use cases demands evolution from legacy assets. XRP's ability to adapt to this utility-first landscape will determine whether it maintains dominance or cedes ground to agile newcomers.

XRP News Today: Top 4 Triggers to Watch for XRP Price Recovery

XRP investors anticipate a potential recovery in October, driven by the expected approval of XRP ETFs and Ripple's bank charter. Despite recent whale sell-offs and profit booking, market sentiment remains cautiously optimistic.

The U.S. SEC has set October 18 as the deadline for Grayscale's XRP ETF decision, with other issuers like Canary, CoinShares, and 21Shares facing a deadline of October 22 or 23. A favorable outcome could catalyze a price rebound.

Federal Reserve rate cuts and technical indicators suggest XRP may overcome its current downtrend. Analysts highlight $5-$10 as a plausible target if bullish momentum resumes.

XRP Price Poised for Rebound as Whale Activity Surges

XRP shows signs of a potential rebound as the TD Sequential indicator flashes a buy signal, coinciding with significant whale activity. A single entity moved 100 million XRP off Bitstamp exchange, signaling accumulation after the token dipped to $2.85.

Technical analysis suggests a breakout above the current pennant formation could propel XRP beyond $4. Crypto analyst Ali Martinez notes the hourly chart's buy signal mirrors the indicator's accurate sell call on August 9, which preceded a 15% drop.

Exchange data reveals growing long positions below $2.90, with whale transactions exceeding $300 million. Market participants appear unfazed by ambitious $5 price predictions, focusing instead on the immediate technical setup.

Ripple Growth Potential: Is XRP the Future of Finance

Ripple shares are gaining traction among retail and institutional investors as the cryptocurrency market faces heightened volatility. While Bitcoin and Ethereum dominate the spotlight, Ripple’s equity and its ties to XRP are emerging as a compelling alternative for exposure to blockchain-based payments.

Ripple Labs, the company behind XRP, remains a focal point in crypto discussions due to its legal battles and push for real-world utility in cross-border transactions. Despite uncertainties, private investors are increasingly drawn to Ripple’s long-term technology and adoption strategy.

Secondary market trading of Ripple shares has seen steady growth, with speculation mounting over a potential IPO. While no public listing has been confirmed, analysts suggest an eventual move could reshape investor sentiment toward the company.

It’s crucial to distinguish between Ripple shares and XRP—the former represents ownership in Ripple Labs, while the latter is a cryptocurrency. Yet, their fates remain intertwined as the company continues to champion blockchain innovation.

XRP Price Prediction: Analysts Target $3.40-$3.48 Range Amid Near-Term Consolidation

XRP shows bullish momentum with analysts projecting a 12-15% surge to $3.40-$3.48 within 30 days, despite potential short-term consolidation near the $3.00 support level. The cryptocurrency currently trades at $3.03, exhibiting mixed but constructive technical indicators.

Coinpedia identifies a bull flag pattern signaling upward potential, while algorithmic models like Price Forecast Bot predict a more aggressive $3.48 target. Divergence emerges as some analysts caution about a bearish pin bar formation that could test the $3.00 psychological threshold before any sustained rally.

Key levels to watch include $3.31 resistance and $2.78 immediate support, with $2.21 acting as a stronger floor. Market participants await Ripple's next move as technical patterns compete with broader market optimism.

XRP Price Poised for Potential 75% Surge Amid Technical and Fundamental Catalysts

XRP price consolidation near $3 may soon give way to significant upside, with technical patterns and regulatory developments aligning for a potential breakout. The cryptocurrency has formed both a bullish flag and a cup-and-handle pattern—historically reliable indicators of impending rallies. Measuring the flagpole's height suggests a near-term target of $4.60, while the cup formation implies a more ambitious $52 target representing 75% upside from current levels.

Market sentiment brightens as speculation grows about SEC approval for spot XRP ETFs, mirroring the institutional embrace seen with bitcoin and ether products. Meanwhile, developer activity on the XRP Ledger ecosystem continues accelerating, with recent protocol upgrades enhancing smart contract capabilities and cross-chain interoperability.

The token's 90% year-to-date gain appears to be just the opening act. Traders note XRP's unusual decoupling from ETH and BNB's recent all-time highs—a divergence that often precedes catch-up rallies in altcoin markets. Liquidity pools across major exchanges show growing institutional interest, with Bybit and Binance seeing particular accumulation in perpetual futures contracts.

Ripple Ends Five-Year SEC Lawsuit as XRP Price Rallies

XRP surged over 7% after Ripple and the US Securities and Exchange Commission jointly dismissed all appeals in their landmark legal battle. The resolution removes a key overhang for the sixth-largest cryptocurrency, with Ripple agreeing to pay a $125 million penalty ordered by Judge Analisa Torres.

The Second Circuit Court's approval of the dismissal marks the conclusion of a case that began in December 2020, when the SEC alleged Ripple conducted unregistered securities offerings through XRP sales. Market participants had closely watched the proceedings as a bellwether for regulatory treatment of digital assets.

Defense attorney James Filan confirmed the court's approval via social media, noting both parties had withdrawn their appeals. The settlement clears the way for Ripple to focus on business operations without the cloud of protracted litigation.

Ripple CEO Calls It a “New Dawn” as U.S. Policy Warms to Crypto

The regulatory landscape for cryptocurrency in the United States is undergoing a seismic shift. After years of stringent enforcement and skepticism, policymakers are now embracing digital assets with open arms. Ripple CEO Brad Garlinghouse describes the change as dramatic, noting Federal Reserve governors openly endorsing blockchain technology—a stark contrast to the adversarial stance of previous years.

Legal experts like John Deaton echo this sentiment, highlighting the industry's rapid evolution from regulatory crackdowns to the cusp of mass adoption. The shift signals a potential inflection point for mainstream crypto acceptance, with XRP and other assets poised to benefit from the newfound political goodwill.

Major Players Adjust Filings For XRP Spot ETF

Seven asset management giants, including Grayscale, Bitwise, and 21Shares, have simultaneously amended their SEC filings for a spot XRP ETF. This coordinated move signals a strategic pivot to address regulatory demands, potentially marking a watershed moment for XRP's institutional adoption.

The amendments introduce technical refinements to fund structures, notably enabling creations in XRP and redemptions in kind. Market observers interpret this unprecedented alignment as evidence of active dialogue with regulators, reflecting the asset managers' anticipation of evolving compliance requirements.

While the SEC maintains its characteristically deliberate pace, this development suggests growing confidence among institutional players in XRP's regulatory trajectory. The cryptocurrency, long relegated to the periphery of traditional finance, may be poised for mainstream portfolio inclusion.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and fundamental developments, here are the projected price ranges for XRP:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $3.40 - $4.20 | $4.50 - $5.80 | $6.00 - $7.50 | ETF approvals, adoption growth |

| 2030 | $8.00 - $12.00 | $15.00 - $25.00 | $30.00 - $45.00 | Mass adoption, regulatory clarity |

| 2035 | $20.00 - $35.00 | $40.00 - $65.00 | $75.00 - $100.00 | Global remittance dominance |

| 2040 | $50.00 - $80.00 | $90.00 - $150.00 | $175.00 - $250.00 | Full ecosystem maturity |

BTCC financial analyst Ava emphasizes that 'these projections assume continued regulatory support, successful ecosystem development, and broader cryptocurrency market growth. Short-term volatility should be expected, but the long-term trajectory appears strongly positive given XRP's utility in cross-border payments and growing institutional interest.'